child care tax credit portal

You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than. For the 2021 tax year the CTC is worth.

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

The Child Tax Credit helps all families succeed.

. The Child Tax Credit will help all families succeed. To be eligible for this rebate you must meet all of the following requirements. You will need the following information if you plan to claim the credit.

These credits are designed to help make child care more affordable for parents. Up to 3600 for each child age 0-5. When you claim this credit when filing a tax return you can lower the taxes you owe and potentially increase your refund.

However the great thing about this is that more families are eligible than for other similar relief programs. View five years of payment history and any pending or scheduled payments. Up to 3000 for each child age 6-17.

E-File Directly to the IRS. Up to 3000 for each child age 6-17. Advance child tax credit payments in 2021.

Canceled checks or money orders. Ad Get Your Maximum Refund Guaranteed Even If Youve Received The Advance Child Tax Credit. The Child Tax Credit provides money to support American families helping them make ends meet.

For children under 6 the amount jumped to 3600. To learn more about recordkeeping requirements see our Checklist for child and dependent care expenses. The child tax credit ctc for 2021 has some important.

Sales Tax Holiday - To learn more about this years Sales Tax Free Week click here. The Advance Child Tax Credit Update Portal is now closed. Join The Millions Who File Smarter And Get Your Taxes Done Right Guaranteed.

Alphabetical List of All States. The Employee Retention Tax Credit ERTC is a great opportunity for child care businesses with W-2 employees. Can signing up with the irs portal before july help me get my payment quicker.

- Click here for updated information. Connecticut State Department of Revenue Services. View data from most recent tax returns and access additional records.

Single parents with incomes up to 112500 and married couples with incomes up to 150000 are eligible for the full benefit. Sales tax relief for sellers of meals. Cash receipts received at the time of payment that can be verified by the department.

The American Rescue Plan increased the Child Tax Credit from 2000 per child to 3000 per child for children over the age of six and from. CNMI Advance Child Tax Credit Update Portal. Everything is included Premium features IRS e-file 1099-MISC and more.

Child care costs rise. Costs in nearly every sector are rising. 25 states have a dependent care tax credit to help parents with the cost of child care.

1400 in March 2021. Have been a US. Another 4 states Idaho Massachusetts Montana and Virginia allow parents a tax deduction for some of their child care expenses.

The Child and Dependent Care Credit is a tax credit that helps parents and families pay for the care of their children and other dependents while they work are looking for work or are going to school. 150000 if you are married and filing a joint return or if you are filing as a qualifying widow or widower. The Advance Child Tax Credit Update Portal is now closed.

Additional information See Form IT-216 Claim for. Ad Home of the Free Federal Tax Return. The Child Tax Credit CTC provides financial support to families to help raise their children.

Thanks to the American Rescue Plan the vast majority of families will receive 3000 per child ages 6-17 years old and 3600 per child under 6 as a result of the increased 2021 Child Tax Credit. The child tax credit update portal now lets you opt out of receiving this years monthly child tax credit payments. Access Child Tax Credit Update portal.

Gas Tax - For updated information on the Suspension of the Motor Fuels Tax click here. You must have claimed at least one child as a dependent on your 2021 federal income tax return who was 18 years of age or younger. In 2021 then you will receive the child tax credit.

Thanks to the American Rescue Plan signed by President Biden in March 2021 more families are eligible for the credit for the first time and. The Child Tax Credit is an addition to the usual Child Tax Credit you may have received in the past. What is the New York City Child Care Tax Credit NYC CCTC.

You may be eligible for a child tax rebate of up to a maximum of 750 250 per child up to three children. If you earned less than 25100 filing jointly less than 18800 if filing as head-of-household or less than 12550 if filing as single you can file quickly on your own to claim the Child Tax Credit. Be your son daughter stepchild eligible foster child brother sister.

Department of Revenue Services.

The Child Tax Credit Toolkit The White House

Haven T Received Your Advance Payment Of The Child Tax Credit Issued To You Yet

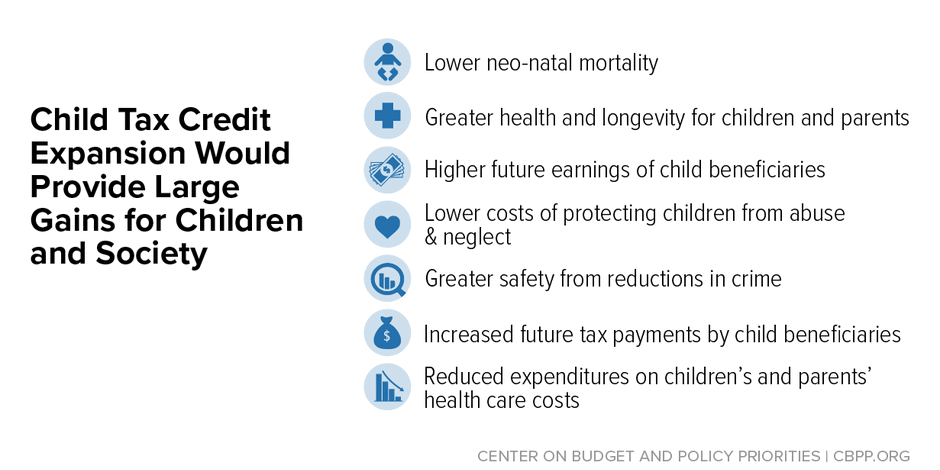

House Bill Takes Major Steps Forward For Children Low Paid Workers Center On Budget And Policy Priorities

Policy Basics The Child Tax Credit Center On Budget And Policy Priorities

Tax Refunds Stimulus Payments Child Credits Could Complicate Filings

The Child Tax Credit Toolkit The White House

List Of 6 Arizona Tax Credits Christian Family Care

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Child Tax Credit Ending Will Push 10 Million Kids Back Into Poverty

2021 Child Tax Credit Advanced Payment Option Tas

December Child Tax Credit Date Here S When To Expect 1 800 Stimulus Check

Childctc The Child Tax Credit The White House

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Education Tax Credits For College Students The Official Blog Of Taxslayer

Stimulus Payments Child Tax Credit Expansion Were Critical Parts Of Successful Covid 19 Policy Response Center On Budget And Policy Priorities

The Advance Child Tax Credit An Opportunity For Hud Assisted Families With Children Hud User

Did Your Advance Child Tax Credit Payment End Or Change Tas

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back